Tickmill is a globally recognized broker offering low-cost ECN trading, institutional-grade liquidity, and professional-level execution. Founded in 2014, Tickmill has built a reputation for transparency, reliability, and competitive trading conditions, making it a popular choice for experienced traders seeking precision and performance.

The broker operates under multiple top-tier regulators, ensuring compliance and safety for clients worldwide:

- FCA (Financial Conduct Authority, UK)

- CySEC (Cyprus Securities and Exchange Commission)

- FSA (Financial Services Authority, Seychelles)

This strong regulatory framework positions Tickmill as a secure and trustworthy broker suitable for both individual and institutional traders.

Market Access and Instruments

Tickmill provides access to a broad selection of global financial markets, enabling traders to build diversified portfolios and take advantage of different trading opportunities.

Available assets include:

- Forex pairs – majors, minors, and exotics

- Stock indices – such as S&P 500, DAX 40, NASDAQ, and FTSE 100

- Commodities – including gold, silver, oil, and other raw materials

- Bonds and cryptocurrencies (available depending on jurisdiction)

Although the product range is focused on core markets rather than extensive diversification, the liquidity and pricing quality make Tickmill highly attractive for serious traders and scalpers.

Trading Platforms

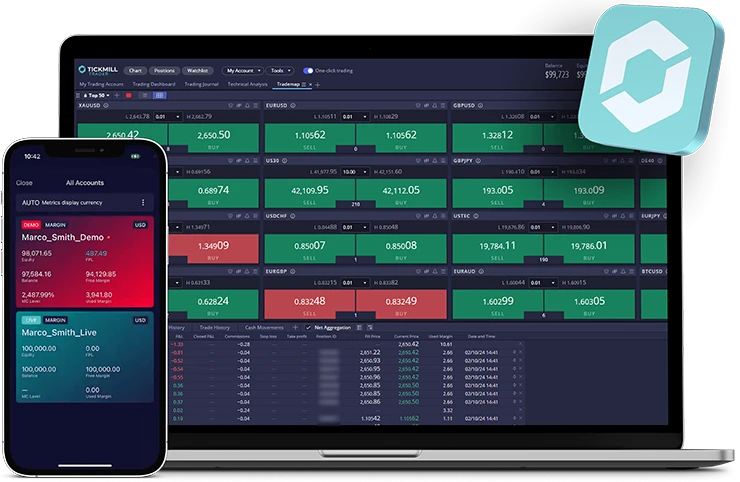

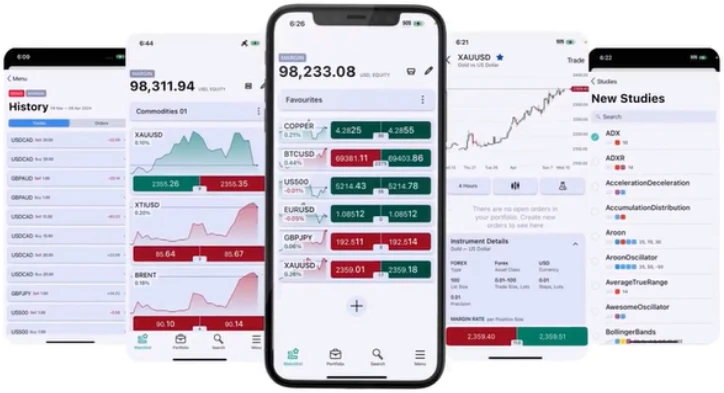

Tickmill supports two of the most widely used trading platforms in the world: MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

- MetaTrader 4 (MT4): A reliable platform for forex trading, offering one-click execution, Expert Advisor (EA) compatibility, and customizable charting tools.

- MetaTrader 5 (MT5): Designed for multi-asset trading, with enhanced analytical tools, more order types, and faster processing.

Both platforms are available on desktop, web, and mobile, ensuring smooth access for traders on the go. However, unlike some competitors, Tickmill does not provide its own proprietary mobile app, relying instead on MetaTrader’s ecosystem.

Account Types and Trading Conditions

Tickmill offers three main account types, each tailored to a specific level of trading experience and strategy:

- Classic Account – Ideal for beginners, featuring zero commissions and slightly higher spreads.

- Pro Account – Designed for experienced traders, offering spreads from 0.0 pips and low commission fees.

- VIP Account – For high-volume professionals with reduced commissions and personalized service.

Key trading conditions:

- Leverage: Up to 1:500 (depending on region and regulation)

- Spreads: Starting from 0.0 pips on Pro and VIP accounts

- Execution Model: ECN (Electronic Communication Network) with direct market access

- Minimum Deposit: From $100 on Classic and Pro accounts

This structure gives traders flexibility in choosing cost-effective solutions based on their goals and trading volume.

Trading Performance and Execution

Tickmill is known for its ultra-fast and transparent execution. The broker routes all orders directly to liquidity providers without a dealing desk, ensuring no requotes and no conflicts of interest.

Advanced server technology located in LD4 Equinix data centers (London) ensures minimal latency and consistent speed — ideal for scalping, high-frequency trading, and algorithmic strategies.

Professional traders can also benefit from free VPS hosting, enabling stable automated trading 24/7.

Education and Research

While Tickmill primarily caters to experienced traders, it also provides a solid range of educational and analytical materials.

- Webinars and video tutorials by market professionals

- Daily analysis and trading insights

- E-books and trading guides for both beginners and advanced users

- Economic calendar and market sentiment indicators

These resources help traders refine strategies and make data-driven decisions based on market trends and expert evaluations.

Customer Support and Service Quality

Tickmill offers multilingual customer support available 24/5 through live chat, email, and phone. The support team is responsive, professional, and knowledgeable about both technical and trading topics.

For high-volume traders, VIP account holders receive priority support and access to personal account managers for more efficient service and account handling.

Security and Fund Protection

Client security is a cornerstone of Tickmill’s operation. As a fully regulated broker, it adheres to strict financial standards and employs multiple safety measures:

- Segregated client accounts to protect funds from company liabilities.

- Negative balance protection, ensuring clients cannot lose more than their deposits.

- Regular audits and compliance monitoring under FCA and CySEC supervision.

These protections enhance trader confidence and reinforce Tickmill’s reputation as a trustworthy and transparent broker.