Plus500 is a globally recognized broker known for its user-friendly trading platform, fast execution, and focus on CFD trading. Established in 2008, Plus500 has become one of the most accessible brokers for beginners, offering a clean, intuitive interface and a transparent pricing model without unnecessary complexity.

The company operates under the supervision of multiple top-tier regulators, ensuring strict compliance and high security standards:

- FCA (Financial Conduct Authority, UK)

- ASIC (Australian Securities and Investments Commission)

- CySEC (Cyprus Securities and Exchange Commission)

These licenses reinforce Plus500’s credibility and commitment to client protection, operational transparency, and financial reliability.

Market Access and Instruments

Plus500 specializes in Contract for Difference (CFD) trading, offering more than 2,500 instruments across a broad range of global markets. Traders can access:

- Forex pairs – major, minor, and exotic currencies

- Indices – including S&P 500, NASDAQ, DAX 40, and FTSE 100

- Commodities – such as gold, silver, oil, and natural gas

- Shares – CFDs on companies listed across U.S., European, and Asian markets

- ETFs – for portfolio diversification

- Cryptocurrencies – including Bitcoin, Ethereum, and Litecoin (depending on region)

This diverse offering allows traders to take advantage of price movements across multiple asset classes without the need to own the underlying assets.

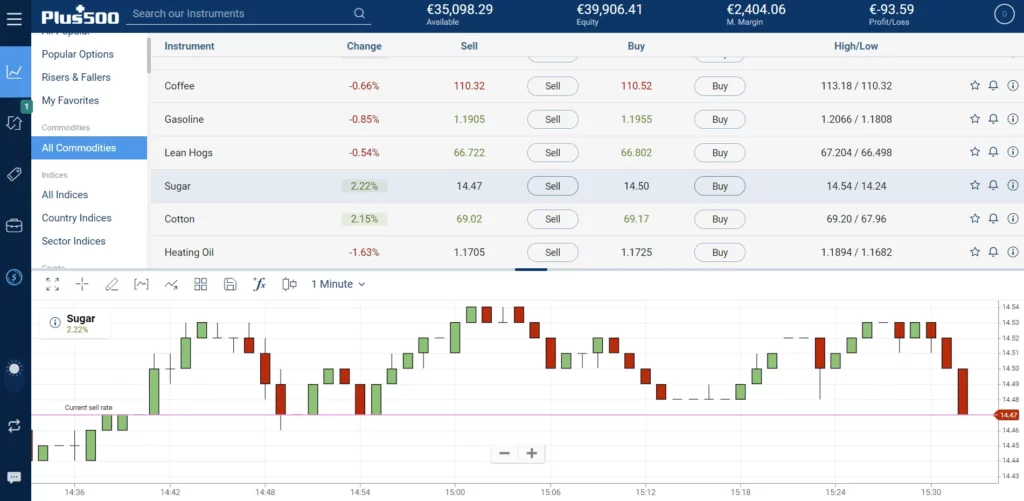

Trading Platform: Plus500 WebTrader

Unlike many brokers that rely on third-party solutions, Plus500 uses its proprietary WebTrader platform, designed for simplicity, speed, and accessibility.

Key features include:

- Clean and intuitive interface suitable for beginners

- Web-based platform – no downloads or installations required

- Real-time quotes and clear order management tools

- Advanced risk management options such as stop loss, trailing stop, and guaranteed stop

- Mobile app for iOS and Android devices with full trading functionality

The Plus500 platform focuses on ease of use rather than complexity, making it perfect for traders who prefer a straightforward trading experience. However, it does not support MT4 or MT5, which may be a limitation for professional or algorithmic traders who rely on advanced customization and automated strategies.

Trading Conditions and Pricing

Plus500 offers tight spreads and transparent trading conditions, suitable for both new and experienced traders.

Core conditions include:

- Spreads: Starting from 0.6 pips on major forex pairs.

- Leverage: Up to 1:30 for retail clients (up to 1:300 for professionals).

- Minimum Deposit: $100, depending on the payment method.

- Execution: Fast and stable, with reliable order processing and minimal slippage.

- Negative Balance Protection: Ensures traders cannot lose more than their deposited capital.

Plus500 operates on a spread-only pricing model, meaning there are no commissions on trades. All costs are included in the spread, offering a transparent approach that helps beginners calculate potential expenses easily.

Risk Management and Margin Policy

One of Plus500’s strongest advantages is its risk management system. The broker maintains fixed margin requirements, ensuring predictable leverage usage and account stability even during volatile market conditions.

Traders can also use built-in tools such as:

- Stop Loss and Take Profit to manage trade outcomes.

- Guaranteed Stop Orders (GSOs) to lock in exit prices for an extra fee.

- Margin Call and Real-Time Alerts to prevent overexposure.

This structure supports disciplined trading and reduces the risk of unexpected losses — ideal for beginners developing proper trading habits.

Education and Research

Plus500 provides basic educational content through its website and platform, including tutorials, FAQs, and risk disclosure materials. While these resources are helpful for entry-level traders, the broker’s research and analytical tools are limited compared to full-service competitors.

There are no in-depth technical indicators, advanced charting systems, or professional-grade analytical resources beyond the platform’s built-in tools. As a result, Plus500 is more suited for straightforward trading rather than complex analysis.

Deposits, Withdrawals, and Customer Support

Funding and withdrawals on Plus500 are fast, simple, and secure, supporting a variety of payment methods:

- Credit/Debit cards

- Bank transfers

- E-wallets (PayPal, Skrill)

Deposits are typically instant, while withdrawals are processed within 1–3 business days. The broker charges no deposit fees and offers transparent currency conversion rates.

Customer support is available 24/7 via live chat and email, providing multilingual service. The support team is responsive and well-trained, assisting users with technical issues, account verification, and platform navigation.

Security and Regulation

As a multi-regulated broker, Plus500 places high importance on client safety and transparency.

- Segregated accounts: Client funds are kept separate from company capital.

- SSL encryption: Protects data and financial transactions.

- Negative balance protection: Prevents traders from losing more than their deposits.

- Publicly listed company: Plus500 is listed on the London Stock Exchange (LSE), adding an extra layer of credibility and financial accountability.

These factors make Plus500 one of the most trustworthy CFD brokers available to retail clients.