eToro is one of the most recognized names in online trading, widely known for pioneering social and copy trading. Established in 2007, eToro has revolutionized retail investing by allowing users to mirror the trades of top-performing investors, combining a social network experience with real financial markets.

The broker operates under strict regulatory supervision from leading global authorities, including:

- CySEC (Cyprus Securities and Exchange Commission)

- FCA (Financial Conduct Authority, UK)

- ASIC (Australian Securities and Investments Commission)

This strong regulatory foundation ensures security, transparency, and investor protection, making eToro one of the most trusted brokers in the fintech sector.

What Makes eToro Stand Out

Unlike traditional brokers, eToro built its success around social interaction and community-driven investing. The platform allows traders to share insights, discuss strategies, and copy trades from successful investors through its CopyTrader™ system.

This innovation transformed trading from an individual activity into a collaborative experience, helping beginners learn directly from experienced market participants while maintaining full control of their accounts.

Market Access and Tradable Instruments

eToro offers access to a wide range of over 3,000 financial instruments across multiple asset classes, giving traders the flexibility to diversify and invest globally. Available instruments include:

- Forex pairs – major, minor, and exotic currencies

- Commodities – gold, oil, silver, and natural gas

- Indices – including S&P 500, NASDAQ, DAX 40, and FTSE 100

- Stocks – CFDs and real shares from global exchanges

- ETFs – providing exposure to diversified portfolios

- Cryptocurrencies – Bitcoin, Ethereum, Ripple, and many more

This vast selection allows users to combine traditional investing and modern trading under one platform.

Platform and Trading Technology

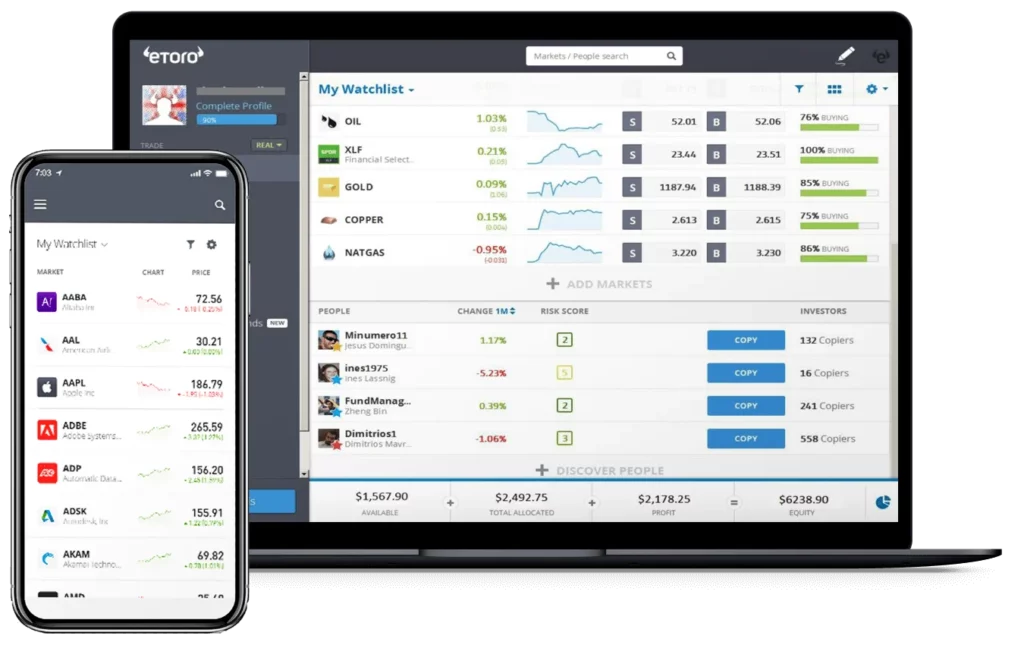

eToro uses a proprietary web-based platform, available on desktop and mobile devices, designed to be intuitive, visually appealing, and easy to navigate.

Key features include:

- CopyTrader™: Instantly copy the trades of successful investors based on their real-time performance.

- CopyPortfolios™: Curated thematic portfolios built around strategies, sectors, or top-performing traders.

- Integrated social feed: Enables traders to follow discussions, comment on trades, and share opinions in a community-like environment.

- One-click trading interface: Simple order execution suitable for beginners.

While the platform offers outstanding usability and unique social functions, it is less customizable and offers fewer advanced technical tools compared to MetaTrader or cTrader, making it less suitable for algorithmic or data-driven professionals.

Trading Conditions and Pricing

eToro operates primarily as a market maker and offers commission-free trading on real stocks and ETFs.

Key conditions include:

- Spreads: Starting from 1.0 pip on major forex pairs.

- Leverage: Up to 1:30 for retail clients (higher for professionals).

- Minimum Deposit: Typically $100, varying by region.

- Fees: No commission on stock trading, but spreads are generally wider than ECN brokers.

eToro also applies small withdrawal and inactivity fees, but these are clearly disclosed, supporting the broker’s reputation for transparent pricing.

Social and Copy Trading Features

eToro’s most defining feature is its social trading ecosystem.

- CopyTrader™: Allows users to automatically replicate the positions of top traders, with performance metrics such as risk score, returns, and trade history available for analysis.

- CopyPortfolios™: Managed investment strategies grouped by market theme or trader performance, functioning similarly to ETFs.

- Social Feed: Encourages idea sharing and community engagement, similar to a financial social network.

These features make eToro especially appealing to beginners and intermediate traders looking to gain exposure to the markets without extensive prior experience.

Education and Research

eToro offers a range of educational materials and market insights designed to help traders grow their skills and understanding:

- eToro Academy with video lessons, guides, and webinars.

- Market news and analysis from in-house experts.

- Economic calendar and sentiment tools for real-time updates.

- Virtual (demo) account for risk-free practice.

Although its educational section is beginner-friendly, professional traders might find the research tools somewhat basic compared to advanced analytical platforms.

Deposits, Withdrawals, and Customer Support

eToro supports a variety of payment methods, including:

- Credit/Debit cards

- Bank transfers

- E-wallets such as PayPal, Skrill, and Neteller

- Crypto-based deposits (available in some regions)

Deposits are processed instantly, while withdrawals typically take 1–3 business days. The platform charges a small fixed withdrawal fee, which is clearly stated during the transaction process.

Customer support is available 24/5 via live chat and a ticket-based system, with multilingual service representatives assisting users worldwide.

Security and Regulation

As a multi-regulated broker, eToro ensures high levels of data protection and client fund safety:

- Segregated client accounts under strict financial oversight.

- Negative balance protection for retail traders.

- Encryption and secure login systems for account safety.

These measures, combined with its long operational history and global presence, make eToro one of the most secure and transparent brokers in the retail trading industry.