AvaTrade stands among the most respected names in online trading, known for its strong regulatory foundation, versatile platforms, and educational support. Founded in 2006, the broker has built a long-standing reputation for reliability, security, and client transparency. With over 15 years of industry experience, AvaTrade serves both beginner and professional traders across multiple continents.

The company operates under global regulation, holding licenses from several top-tier authorities, including:

- ASIC (Australian Securities and Investments Commission)

- FSCA (Financial Sector Conduct Authority, South Africa)

- ADGM (Abu Dhabi Global Market)

- FSA (Financial Services Authority, Japan)

These licenses reinforce AvaTrade’s credibility as one of the most regulated brokers in the world, ensuring compliance with international financial standards and protecting client funds through strict oversight.

Trading Instruments and Market Access

AvaTrade provides access to a wide range of financial markets, offering over 1,250 instruments across various asset classes:

- Forex – major, minor, and exotic currency pairs

- Commodities – such as gold, silver, oil, and natural gas

- Indices – including the S&P 500, NASDAQ, FTSE 100, and DAX 40

- Stocks – CFDs on global companies like Apple, Tesla, and Amazon

- Cryptocurrencies – Bitcoin, Ethereum, Ripple, and more

- ETFs and Bonds (depending on jurisdiction)

This diversity makes AvaTrade an appealing option for traders who seek to diversify portfolios and manage multiple asset types within one account.

Trading Conditions and Account Types

AvaTrade offers both fixed and floating spreads, giving traders flexibility in how they manage costs and market exposure.

- Minimum Deposit: From $100, accessible for all experience levels.

- Leverage: Up to 1:400 (depending on region and regulation).

- Spreads: Fixed spreads from 0.9 pips or floating spreads starting at 0.6 pips.

- Execution Model: Market execution with no dealing desk intervention.

The broker does not offer Direct Market Access (DMA), which may limit access for institutional-level traders. However, AvaTrade compensates with consistent pricing, advanced tools, and low trading costs suitable for retail and semi-professional users.

Platforms and Technology

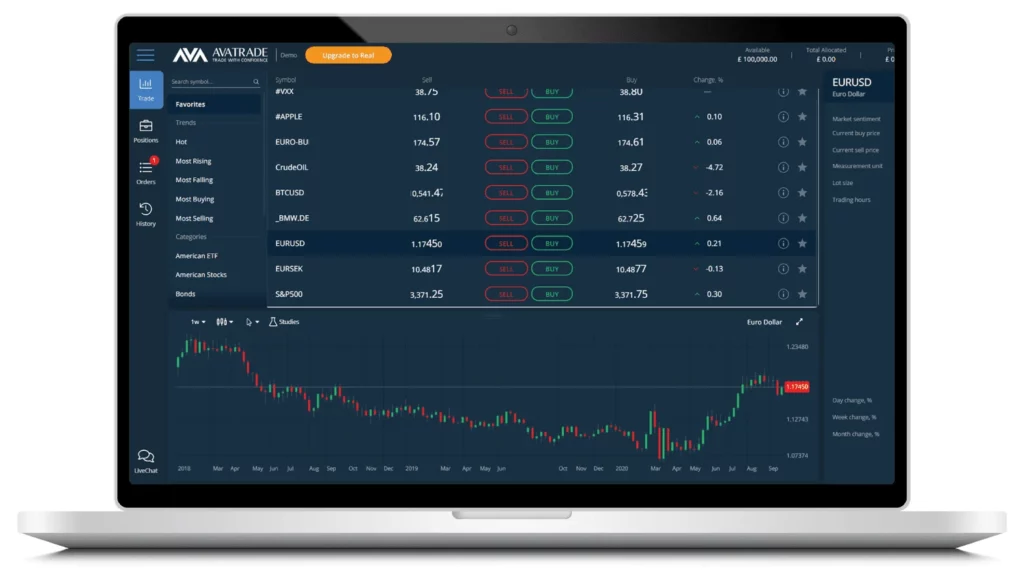

AvaTrade supports several trading platforms, ensuring flexibility for all types of traders:

- MetaTrader 4 (MT4) and MetaTrader 5 (MT5) – for advanced charting, automation, and algorithmic trading.

- AvaTradeGO – a modern mobile app offering one-touch trading, real-time analytics, and social features.

- WebTrader – browser-based, user-friendly, and accessible without installation.

In addition, AvaTrade offers social trading integration through AvaSocial and DupliTrade, allowing traders to copy strategies from professionals or share their own insights with others. These options appeal to beginners who want to learn by following experienced investors.

Education and Research

AvaTrade places strong emphasis on trader education and knowledge building. The broker offers:

- Video tutorials covering trading basics and platform use

- Daily market analysis and trading insights

- E-books, webinars, and strategy guides

- Economic calendar and sentiment indicators

This makes AvaTrade especially valuable for beginner and intermediate traders, who can combine learning resources with live trading practice.

Customer Support and Service Quality

AvaTrade’s customer support is available 24/5 via live chat, email, and phone. The support team provides multilingual assistance and fast response times for technical and trading-related queries.

The broker also maintains regional offices across Europe, Asia, and the Middle East, allowing for localized service and compliance support. Overall, its client service is rated as professional, consistent, and accessible to traders in multiple time zones.

Fees and Additional Charges

While AvaTrade’s spreads and commissions are competitive, it does apply inactivity fees for dormant accounts. Traders who remain inactive for a prolonged period may face a monthly charge after a certain time frame.

However, the broker does not charge deposit or standard withdrawal fees, making it cost-efficient for active traders.